The following excerpt from the book “Informed Consent” by Benjamin Brown, MD

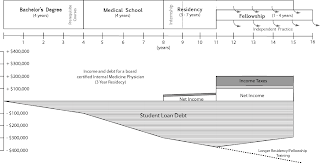

Physicians spend about 40,000 hours training and over $300,000 on their education, yet the amount of money they earn per hour is only a few dollars more than a high school teacher. Physicians spend over a decade of potential earning, saving and investing time training and taking on more debt, debt that isn’t tax deductible. When they finish training and finally have an income – they are taxed heavily and must repay their debt with what remains. The cost of tuition, the length of training and the U.S. tax code places physicians into a deceptive financial situation.

Want to know more about the U.S. medical education system?

Purchase my book at: www.InformedConsentBook.com

The road to becoming a licensed and board certified physician is a long one. Physicians spend the equivalent of 20 years of full-time work just learning how to be a physician. First, one must earn a bachelor’s degree. Attending college full time, this will take about four years or 6,400 hours of work. 4 years x 40 wks/yr x 40 hrs/wk = 6,400 hours. To be competitive for acceptance into medical school you will likely spend far more than 40 hours per week studying, doing research and volunteering. However, to keep it simple and consistent we will neglect that extra time. After college future physicians must attend medical school. Medical students spend about 80 hours per week for 48 weeks each year studying and training which amounts to 15,360 hours over four years. After medical school, physicians must complete post-graduate training known as residency. To practice medicine in the United States physicians must pass all 3 parts of the United States Medical Licensing Exam (USMLE©) and complete at least the first year of residency, which is known as internship. Residents work long hours, weekends, nights and holidays. Most approach the legal work hour limit of 80 hrs/week for 50 weeks each year. Many residents exceed 80 hrs/wk studying and doing research in addition to their clinical responsibilities. To become board certified, future physicians must complete an entire residency-training program and pass all additional exams for that particular specialty. For example, to become board certified in Internal Medicine, one must graduate from medical school, pass all 3 USMLEs, complete a 3-year Internal Medicine residency and pass the Internal Medicine board exam. A board certified Internal Medicine physician will spend about 34,000 hours training. To become board certified in Thoracic Surgery – one must graduate from medical school, pass all 3 USMLEs, complete a 5-year General Surgery residency, complete a 2-year thoracic surgery fellowship and pass the Thoracic Surgery board exams. A board-certified Thoracic Surgeon will spend about 49,760 hours training. The shortest residency training programs are 3 years long and include the primary care specialties of Internal Medicine, Family Medicine and Pediatrics.

Spending 40,000 hours of one’s young adult life learning how to be a physician is an admirable sacrifice, especially considering one must spend more money than one earns to work those 40,000 hours. The long hours don’t necessarily end after residency. In 2007, physicians from over 20 specialties were asked how many hours per week they generally work – the average was 59.6 hours per week.1 So even after physicians finish their 40,000 hours of training they continue to work one-and-a-half times as much most Americans for the rest of their career. In short, physicians work two-full time jobs while in training and one-and-a-half full time jobs when they are finished. They have to work nights, evenings, weekends, holidays and take call. For most physicians, there is no such thing as overtime or holiday pay.

Why does it have to take so long?

There are no shortcuts to gaining the knowledge and experience one needs to be a competent physician, they need to put in the time to get the experience. Because there is no shortcut to gaining the experience one needs to be a competent physician, decreasing resident work hours from 80 hours per week to 60 hours per week is a terrible idea. If such a change occurs, residency training would have to become years longer in order to get the same experience. Making physician training longer will further increase student debt loads and decrease the number of years physicians are able to work after they are trained. It will increase the number of physicians in training and decrease the physician workforce.

Becoming a physician is expensive. For the 2009-2010 academic year, the average total student budget for public and private undergraduate universities was $19,338 and $39,028, respectively.2 If one attends an average priced institution, receives subsided loans and graduates in four years they will have about $100,000 of student loan debt from college. For the 2009-2010 academic year, the median cost of tuition and fees for public and private medical schools was $24,384 and $43,002 per year, respectively.3 This does not include the cost of rent, utilities, food, transportation, health insurance, books, professional attire, licensing exams fees or residency interview expenses. Therefore, the average medical student budget is about $45,000 per year; $30,000 for tuition and $15,000 for living expenses. If one attends an average priced medical school, receives 1/3 subsidized loans and graduates in 4 years; at a 7% APR they will have $200,527 of debt from medical school at graduation. If one borrows $22,500 bi-annually and two-thirds of this accrues interest compounded bi-annually at 3.5% – their total student loan debt for both college and medical school will then be $300,527. Forbearing this debt through 5 years of residency and paying it off over 20 years will cost about $788,880 of one’s net income.

Loan repayment programs such as those offered by the military are not a solution for the majority. Each year, about 22,000 medical students graduate from U.S. allopathic and osteopathic medical schools.4,5 Each year the military matches 800 students into its residency training programs, because that is the military’s anticipated future need for physicians.

The U.S. tax code allows taxpayers to deduct a maximum of $2,500 per year of student loan interest paid to their lender. This deduction is phased out between incomes of $115,000 and $145,000.6 Therefore, this benefit is of no help to most physicians. If one were to start a business, they could deduct nearly all of their expenses. Yet for unclear reasons, one cannot deduct the cost of becoming a physician; not the tuition or even the interest on the money they borrowed to pay their tuition.

During residency, if one makes payments of $1,753 per month, or $21,037 per year, to pay off the accruing interest, thier debt will be still be $300,527 at the end of residency. However, they will have spent $63,111 over the course of a 3 year residency or $126,222 over the course of a 6 year residency to keep their debt from growing. Though paying off the interest during residency is the responsible thing to do; coming up with $21,037 each year from one’s net pay of $40,000 may be quite difficult.

Time spent training, student loan debt and the U.S. tax code makes the income of physicians deceiving. A board certified internal medicine physician who is married with 2 children, living in California and earning the median internist annual salary of $205,441 will be left with $140,939 after income taxes and $106,571 after student loan payments.7 This is assuming a federal Income tax rate of 28%, California state income tax rate of 6.6%, Social Security tax rate of 6.2% and Medicare tax rate of 1.45%. You can go to www.paycheckcity.com to get an idea of what one’s net pay would be for different incomes, states of residence, marital status, number of children, etc. Paying off a debt of $369,425 over 20 years at a 7% APR will require annual payments of $34,368. Those student loan payments will continue to consume about $34,000 of their net income for 20 years until they are finally paid off. What started off as $300,527 in student loan debt will end up costing $687,360. This debt that consumes one-fourth of their net income for 20 years wasn’t accrued because they bought a house they couldn’t afford – it is because they chose to become a physician. Believe it or not, the amount of money reaching a physician’s personal bank account per hour worked is only a few dollars more than that of a high school teacher.

In order to make this calculation we will neglect inflation of the U.S. dollar by assuming that inflation will increase at the same rate as the purchasing power of the U.S. dollar decreases. We will also assume that physician incomes keep pace with inflation. We will also assume that tuition costs, student loan interest rates, resident stipends, physician reimbursements and the U.S. income tax structure are as described above and do not change.

The median gross income among internal medicine physicians is $205,441.7 The median net income for an internist who is married with two children living in California is then $140,939. Internal medicine is a three-year residency, so throughout residency they will earn a total net income of about $120,000 and spend about 35,000 hours training after high school. The total cost of training including interest, forbeared for three years and paid off over 20 years as explained above is $687,260. One study reported that the average hours worked per week by practicing Internal Medicine physicians was 57 hours per week.8 Another study reported the mean to be 55.5 hours per week.9 We will use 56 hours per week and assume they work 48 weeks per year. If they finish residency at 29 years old and retire at 65 years old they will work for 36 years at that median income.

[(140,939 x 36) + (120,000) – (687,260)] / [(56 x 48 x 36) + (34,000)] = $34.46

The adjusted net hourly wage for an internal medicine physician is then $34.46

The median gross income among high school teachers, including the value of benefits but excluding their pension, is about $50,000.10 The median net income for a high school teacher who is married with two children living in California is then $42,791. This is assuming a federal Income tax rate of 15%, California state income tax rate of 6.6%, Social Security tax rate of 6.2% and Medicare tax rate of 1.45%. You can go to www.paycheckcity.com to get an idea of what one’s net pay would be for different incomes, states of residence, marital status, number of children, etc. Teachers spend about 6,400 hours training after high school, the amount of time it takes to get a bachelor’s degree. The total cost of training if one attends an averaged priced institution and pay off their debt over 20 years at a 7% interest rate is $186,072. At this income one would be able to deduct the interest on their student loans from their income taxes; however, those savings are not accounted for in the calculation below. High school teachers have about 10 weeks off each summer, 2 weeks off during Christmas, 1 week off for spring break and 1 week of personal paid time off. Therefore, high school teachers who work full time average of 40 hours per week for 38 weeks each year. Yes, teachers spend time “off the clock” preparing for class, correcting papers, etc. However physicians also spend time “off the clock” reading, studying, going to conferences, etc. If a high school teacher finishes college at 22 years old and retires at 65 years old, they will work for 43 years. Most teachers also receive a pension. We will assume their gross annual pension including the value of benefits is $40,000 which is a net pension of $35,507. If they die at 80 years old they will receive this pension for 15 years. [(42,791 x 43) + (35,507 x 15) – (186,072)] / [(40 x 38 x 43) + (6,400)] = $30.47

The adjusted net hourly wage for a high school teacher is then $30.47

The median gross income among internal medicine physicians is $205,441.7 The median gross income among high school teachers, including the value of benefits but excluding their pension, is about $50,000 per year.10 Accounting for time spent training, student loan debt, years worked, hours worked per year and disproportionate income taxes – the net adjusted hourly wage of an internist is $34.46 per hour, while that of a high school teacher is $30.47 per hour. Though the gross income of an internal medicine physician is 4 times that of a high school teacher, the adjusted net hourly wage of an internal medicine physician is only 1.13 times that of a high school teacher. Most people would argue that high school teachers are not paid enough, yet for some reason most people would also argue that physicians are paid too much.

Isn’t taking care of patients rewarding regardless of income?

Yes, taking care of patients is rewarding. However, when physicians are unfairly reimbursed for their services they feel exploited. This feeling of exploitation or being taken advantage of is what bothers physicians the most. Physicians spend 40,000 hours training after high school and take out over a quarter million dollars in loans all so that when they are done they can work 60 hours per week, be paid less than they were expected, give about 40% of their income to the government in taxes and pay 25% of their net income to their student loan lender. They feel exploited because after all that they have sacrificed they are enslaved to the highly regulated healthcare industry, which unfairly pays them.

On June 18, 2010 the Centers for Medicaid and Medicare Services (CMS) instructed its Medicare contractors to start processing claims for physician payments at a 21.3% reduced rate.11 Should other payers follow Medicare, as they so often do, physicians may have to find another line of work. Decreasing a physician’s reimbursements by 21.3% doesn’t mean that a physician’s gross income will go from $200,000 to $157,400 – it will likely decrease much, much more. Let’s say Dr. Smith, an internal medicine physician, spends 15 minutes caring for a Medicare patient and bills Medicare $100 for this service. From that visit, Dr. Smith’s profit margin is say 40%, $60 to cover her overhead and $40 profit. Prior to this recent change, Medicare typically paid about 60 cents on the dollar, which is why most physicians barely broke even caring for Medicare patients. The 21.3% decrease in physician reimbursements will likely be 21.3% of that $60, so Dr. Smith will now be reimbursed only $47.22 dollars for that visit which is less than the $60.00 it cost Dr. Smith to see the patient. Therefore, Dr. Smith will spend $12.78 to care for that Medicare patient. This is generous of Dr. Smith and all, but it is unsustainable. It is unsustainable for Dr. Smith and unsustainable for the future of medicine.

In an era of skyrocketing healthcare costs, an increasing need for healthcare services and diminishing resources – Americans need to be cognizant of whom they exploit. Physicians want to work hard and do whatever they can for their patients. And like every other American, physicians also want to be appreciated and fairly compensated for their time and financial sacrifice.

Addendum #1 – The Net Adjusted Hourly Wage of Dentists and Nurses

The median gross income among general dentists who work full time in a group practice is $220,000.(12) The median net income for a general dentist who is married with two children living in California is then $149,681. General dentists who work full time in a group practice with partners work an average of 38 hours per week, 1,727 hours per year.(12) Dentists spend about 17,920 hours training after high school. The total cost of training if you attend averaged priced institutions pay off your debt over 20 years at a 7% interest rate is $558,216. If you finish dental school at 26 years old and retire at 65 years old they will work for 39 years.

[(149,681 x 39) – (558,216)] / [(1,727 x 39) + (17,920)] = $61.91

The adjusted net hourly wage for a general dentist is then $61.91

The median gross income of a registered nurse is $62,450.(13) The median net income of a registered nurse who is married with two children and lives in California is then $51,787. To become a registered nurse via the associate’s degree route takes 2 years, about 4000 hours of training. The average total student budget at a public 2-year university is $14,285.(14) The total cost of becoming an R.N. is then $28,570. If that debt is paid off over 20 years at a 7% interest rate it will end up costing a total of $53,160. At this income you will be able to deduct student loan interest costs from your federal income taxes, these savings are not included in the calculation below. If you finish nursing school at 20 years old and work until you are 65 years old you will work for 45 years at that median income. We will assume you work 40 hours per week, 50 weeks per year.

[(51,787 x 45) – (53,160)] / [(40 x 50 x 45) + (3,200)} = $24.43

The adjusted net hourly wage for a registered nurse is $24.43

What if an R.N. worked as much as an internal medicine physician? Unlike a physician, an R.N. would receive overtime pay for the hours they worked in excess of 2,000 per year.

Variables that will decrease a physician’s adjusted net hourly wage include: a shorter career, increased taxation, decreased income, working more hours for the same or less pay, spending more than average on tuition, spending more time training and decreased resident pay.

Variables that will increase a physician’s adjusted net hourly wage include: a longer career, decreased taxation, increased income, working fewer hours for the same or more pay, spending less than average on tuition, having less debt, paying off your debt early and increased resident pay.

1. Anim M, Markert RJ, Wood VC, Schuster BL. Physician practice patterns resemble ACGME duty hours. Am J Med 2009;122(6):587-93.

2. 2009 Total Student Budgets, 2009-2010. In Trends in Higher Education. The College Board, Annual Survey of Colleges .

3. U.S. Medical Schools Tuition and Student Fees – First Year Students 2009-2010 And 2008-2009. 2010 2010.

4. U.S. Medical School Applicants and Students 1982-83 to 2009-10. AAMC; 2009.

5. AACOMAS Matriculant Profile of 2009 Entering Class. Chevy Chase, MD2009.

6. Publication 15 Cat. No. 10000W. In: Treasury, editor: Internal Revenue Service; 2010. p 40.

7. 2009 Physician Compensation Survey. Alexandria, VA2009.

8. Dorsey ER, Jarjoura D, Rutecki GW. Influence of controllable lifestyle on recent trends in specialty choice by US medical students. JAMA 2003;290(9):1173-8.

http://www.eyedrd.org/2011/02/deceptive-income-of-physicians.html

No comments:

Post a Comment

your comment - ý kiến của bạn